Portfolio Strategy

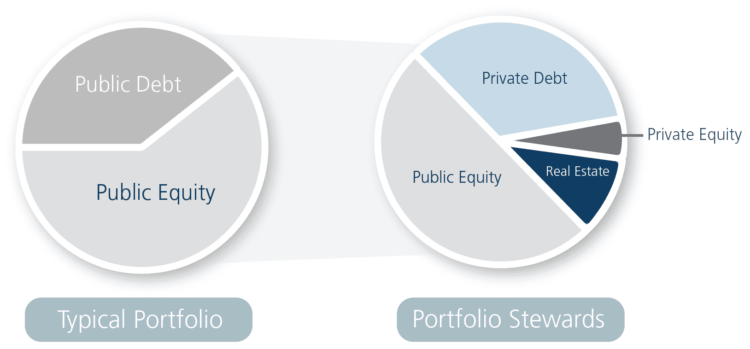

We specialize in designing diversified portfolios that aim to generate the best possible returns while minimizing risk.

Our team of experienced professionals have a deep understanding of the financial markets and use this knowledge to carefully develop and manage unique strategies that have a history of generating superior risk-adjusted performance.

We understand that success in investing is about balancing your assets.

Studies have shown that 91.5% of portfolio return is driven by asset allocation. That is, holding the right asset classes vs. picking the right stocks. Some traditional asset classes, like publicly traded bonds have become ineffective in today’s low interest rate environment, as they perform best during periods of high or declining interest rates. Stocks have become more volatile and are not always right for more cautious investors. Every portfolio should be designed within your comfort zone to achieve returns to help you achieve your goals at the lowest risk possible.

Scientific Risk Assessments

To find your comfort zone, we utilize an innovative risk assessment tool based on the principles of behavioral finance. This assessment allows us to understand you and your motivations deeper than a standard risk assessment in order to determine the appropriate portfolio structure.

Our Private Investing Strategy

Portfolio Stewards is continually evaluating new funds and opportunities as they come available. We invest in private opportunities that are managed by strong, experienced management teams with a focus on protection of investor funds first and generating equity-like returns.

Some examples include residential mortgages, loans backed by receivables storage facilities, music royalties and life settlements to name a few. Each of these are currently generating high single digit returns and monthly income.

Learn more

Due Diligence

Before we consider any new investment opportunities, we have a rigorous internal due diligence process. After investing in a fund, we conduct quarterly interviews with fund managers to keep up-to-date with the status of the fund and address any questions that arise. These interviews are recorded and available for viewing by our clients in our Due Diligence Library.

To demonstrate our commitment to this new asset class, we have created a new site to educate investors about this new asset class and new investment concepts.